"Do not scatter your shot. The great successes of life are made by concentration" Andrew Carnegie

In the commentary of the "Intelligent Investor" by Jason Zweig, most of the richest people in this world have made their fortunes by putting all their investments in one single basket.

On the flipside, he also noted that "Most big fortunes have been by one investment, while no small fortunes have been made this way and not many big fortunes have been kept this way."

We are suggesting that you should make a small fortune in soccer betting by spreading out your bets.

ALLOCATION

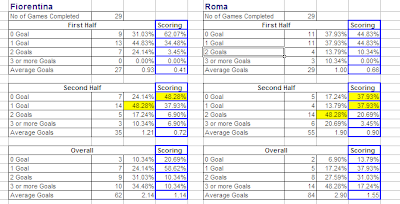

In market investments, it is most ideal to spread out in stock and bonds. This is known as allocation. In soccer betting, you first allocate your bets in a few leagues that produce the more consistent outcomes.

For example, if you invest in goals, you will want to choose consistent goal leagues such as Dutch Eredivisie and EPL. If you like picking teams to win, you should focus on a few leagues that have big guns who keep winning.

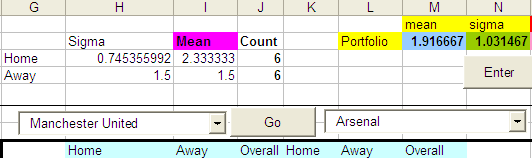

Next, you set up the % of funds that you want to invest in each league. For each league, you should choose only up to 30% of the best games of each league to bet on.

For example:

Dutch Eredivisie - 50% of funds (3 games)

English Premier League - 30% of funds (3 games)

German Bundesliga - 10% (2 games)

Spanish La Liga - 10% (2 games)

Along the way, you may change your allocation to keep up with trends. As trends will keep changing, never over-invest in one team or over-invest in one league. Unless you are controlling the game, there is no such thing as a sure result

You must have discipline to keep the structure of your portfolio.