"There are no good or bad stocks, only cheap and expensive stocks."

"One of the quickest ways to lose money in the market is to listen to others and all of their so-called expert opinions. To succeed, you must ignore all outside opinions and predictions. Follow your own strategy!"

"The best speculators search only for the very best opportunities. To be truly successful, you must wait for the right opportunities to present themselves and this often means doing nothing for long periods of time."

"Perfection has no role in successful trading. No one can buy at the absolute lowest price and sell at the highest price. No time or effort should be devoted to that goal. "I never bought a stock at the low or sold one at the high in my life. I am satisfied to be along for most of the ride."

"You should expect to be wrong half of the time. Your goal is to lose as little as possible when you are. "I have no ego in the stock market. If I make a mistake I admit it immediately and get out fast. If you could play roulette with the assurance that whenever you bet $100 you could get out for $98 if you lost your bet, wouldn't you call that good odds?""

Source: http://www.minyanville.com/investing/articles/nicolas-darvas-darvas-trading-traders-trading/3/9/2011/id/33254

Want us to write articles on any topics? Or need us to provide any statistics? E-mail us at moneyinvestmentstrategies@gmail.com

Wednesday 13 April 2011

Thursday 7 April 2011

Whether Football Betting is Speculation depends on Investment Style

There are many roads to Rome. There is not only one method to invest. Not everyone will agree that value investing is the right way. Famed hedge fund manager Michael Steinhardt, who recently criticised Warren Buffet, was very successful using macro trading.

Macro trading tries to predict how economies move and investing based on these trends. For example, if the world economy is growing too fast, you might predict that oil prices will increase. If oil prices increase, it would increase profit margins of energy companies such as Exxon and Shell. You would buy a few energy companies, anticipate central banks to fight inflation, then sell them for a profit.

In soccer betting terms, you would look at how many goals are scored weekly in the EPL and try to predict trends. If you think that there would be many goals in the particular week, you would choose a few teams which are high scoring and have good match ups. Instead of choosing one or two particular games, you will need to bet on a particular "industry". For example, "Champions League" industry, you are thinking that the top 5 teams are going to score many goals this week, you will place on at least 3 of the games to go over.

Macro traders will use different types of trading instruments, to achieve success. It would include more speculative instruments such as options and futures. In value investing, the first rule of investing is the preservation of capital. Thus options and futures are considered as speculation since there are no underlying assets.

We have previously stated that football betting has no underlying assets and is more closely related to options and futures. Your investment style and character should determine whether football betting is possible.

Macro trading tries to predict how economies move and investing based on these trends. For example, if the world economy is growing too fast, you might predict that oil prices will increase. If oil prices increase, it would increase profit margins of energy companies such as Exxon and Shell. You would buy a few energy companies, anticipate central banks to fight inflation, then sell them for a profit.

In soccer betting terms, you would look at how many goals are scored weekly in the EPL and try to predict trends. If you think that there would be many goals in the particular week, you would choose a few teams which are high scoring and have good match ups. Instead of choosing one or two particular games, you will need to bet on a particular "industry". For example, "Champions League" industry, you are thinking that the top 5 teams are going to score many goals this week, you will place on at least 3 of the games to go over.

Macro traders will use different types of trading instruments, to achieve success. It would include more speculative instruments such as options and futures. In value investing, the first rule of investing is the preservation of capital. Thus options and futures are considered as speculation since there are no underlying assets.

We have previously stated that football betting has no underlying assets and is more closely related to options and futures. Your investment style and character should determine whether football betting is possible.

Tuesday 5 April 2011

The Final Rule of Value Investing: Margin of Safety

The fifth and final rule of value investing is the importance of having a "Margin of Safety". In the simplest interpretation, it means to buy a stock that is worth more than it is currently priced.

The margin of safety rules are created by the individual investor. For example, some would suggest that the buying price should be 50% of your expected valuation. For others, they would think that 30% is sufficient.

Expected Valuation of Company A: $400

Margin of Safety 50%: $200 (You should buy Company A shares at $200)

We think that the most difficult part of this concept is calculating the expected valuation. You may think that Apple shares are worth $400, while someone else will think its worth only $300. Although nobody can ever predict the future accurately, you should at least have a reliable method of predicting.

APPLICATION TO SOCCER BETTING

In our last post, we pointed out that Manchester United and Blackpool are the teams that have 70% of their games finishing with at least 3 goals.

If you believe there are going to be 3 goals, let's consider a few margin of safety options.

16% MOS: Over 2.5 goals

33% MOS: Over 2 goals

50% MOS: Wait till half-time only. If a game has no goals, you have a choice to place over 1.5 goals or wait for 1 ball to further increase MOS.

If the goal comes before you placed your bet, using a Margin of Safety means you have given up an opportunity cost. You should never let yourself be concerned about losing opportunities. In true investment, you should always think about preserving your capital.

The margin of safety rules are created by the individual investor. For example, some would suggest that the buying price should be 50% of your expected valuation. For others, they would think that 30% is sufficient.

Expected Valuation of Company A: $400

Margin of Safety 50%: $200 (You should buy Company A shares at $200)

We think that the most difficult part of this concept is calculating the expected valuation. You may think that Apple shares are worth $400, while someone else will think its worth only $300. Although nobody can ever predict the future accurately, you should at least have a reliable method of predicting.

APPLICATION TO SOCCER BETTING

In our last post, we pointed out that Manchester United and Blackpool are the teams that have 70% of their games finishing with at least 3 goals.

If you believe there are going to be 3 goals, let's consider a few margin of safety options.

16% MOS: Over 2.5 goals

33% MOS: Over 2 goals

50% MOS: Wait till half-time only. If a game has no goals, you have a choice to place over 1.5 goals or wait for 1 ball to further increase MOS.

If the goal comes before you placed your bet, using a Margin of Safety means you have given up an opportunity cost. You should never let yourself be concerned about losing opportunities. In true investment, you should always think about preserving your capital.

Friday 1 April 2011

Applying the Rules of Value Investing

Here we conclude the rules of value investing for soccer betting.

Rule #1: Only invest in what you can understand

Leagues that you do not understand should never be touched. We have recommended that the Dutch Eredivise and EPL are the best leagues in terms of goal scoring and also have sufficient information available on the teams.

Rule #2: Never put your eggs in one basket

Build a portfolio. Diversify your bets. If you lose just one big bet, you have to gamble to get back to your original position. By diversifying, you lower your risks and increase your margin of safety.

Rule #3: Invest only in undervalued bets of high grade teams

We suggest that you should invest only on high scoring teams at undervalued bets. For example, if a team averages 3 goals per game, odds at 2.75 or lower are undervalued.

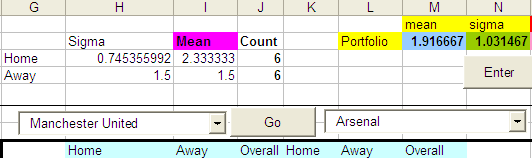

Blackpool, WBA, Man United, Arsenal and Blackburn all have averages of 3 goals. However, this is still not good enough. The tables below give a better picture.

Blackpool and Man United are the best teams as they are at 70%. Hypothetically if you had managed to placed on over 2.5 ball every single game, you should have 40% returns. You will still realize that the margin of safety is not high. Nevertheless, you know that these are the best teams to bet on.

Rule #4: Do your quantitative or statistical analysis

Trying to predict results without any hard statistics is suicidal for any type of investment. When you lose, you will have no idea why you lost.

Rule #5: The final rule, the secret of sound investing, we shall reveal in our next post.

Rule #1: Only invest in what you can understand

Leagues that you do not understand should never be touched. We have recommended that the Dutch Eredivise and EPL are the best leagues in terms of goal scoring and also have sufficient information available on the teams.

Rule #2: Never put your eggs in one basket

Build a portfolio. Diversify your bets. If you lose just one big bet, you have to gamble to get back to your original position. By diversifying, you lower your risks and increase your margin of safety.

Rule #3: Invest only in undervalued bets of high grade teams

We suggest that you should invest only on high scoring teams at undervalued bets. For example, if a team averages 3 goals per game, odds at 2.75 or lower are undervalued.

Blackpool, WBA, Man United, Arsenal and Blackburn all have averages of 3 goals. However, this is still not good enough. The tables below give a better picture.

Blackpool and Man United are the best teams as they are at 70%. Hypothetically if you had managed to placed on over 2.5 ball every single game, you should have 40% returns. You will still realize that the margin of safety is not high. Nevertheless, you know that these are the best teams to bet on.

Rule #4: Do your quantitative or statistical analysis

Trying to predict results without any hard statistics is suicidal for any type of investment. When you lose, you will have no idea why you lost.

Rule #5: The final rule, the secret of sound investing, we shall reveal in our next post.

Wednesday 30 March 2011

The Financial Statements

Previously, we wrote very briefly on how analysts use fundamental analysis to examine stocks. Typically these analysts would first analyze the financial statements of the firm. In the same way, every football team has such "report cards". We shall examine Manchester United's EPL record here.

We have upgraded the Goals Frequency Chart to include the scoring ability of a team over the whole season, past 10 games and past 3 games. You will observe that Man United's scoring ability has fallen over the past few games. Average goals in the whole game have dipped from from 2.1 to 1 for 10 games against 3 games.

We will compare the Goals Frequency Chart to a firm's income statement. An income statement is a financial statement that gives operating results for a specific period. So the Goals Frequency Chart explains how well a team has performed for the whole season, 10 games and 3 games.

Our next post we shall cover more "financial statements" to give a comprehensive picture of a team's past performance.

Subscribe to:

Posts (Atom)